2025 Outlook Real Estate

Disclaimer: The information and materials prepared are for internal use only and on how the Dancap Family Investment Office (“Dancap”) views current market dynamics. Dancap does not guarantee the accuracy or completeness of the material and it is not intended in any manner to be investment, financial, legal, accounting, tax or other advice and should not be relied upon.

Dancap's Current Real Estate Strategy

October 2025

Dancap has over 30 years of track record investing in real estate through third party funds, co-investments, and direct investments in major cities across North America. This market overview focuses on Dancap’s current real estate holdings based on type of investment and location and looks to provide an update on current market dynamics, outlook, and future risks.

The majority of the Dancap real estate portfolio is invested in B-class, US multifamily value-add properties in high-growth cities through funds and co-investments. Our real estate portfolio focuses on US multifamily value-add opportunities because of the strategy’s strong risk-adjusted returns coming from cost-effective CAPEX programs, organic rent growth, stable operating expenses, and strategic exit timing. We are a passive limited partner and target a minimum net 15% IRR and 2.0x MOIC over a five year hold for value-add opportunities. A smaller portion of our real estate portfolio holdings are invested in residential high-rise condo developments in the Greater Toronto Area, targeting a minimum net 20% IRR for new construction developments.

US Multifamily Real Estate Strategy

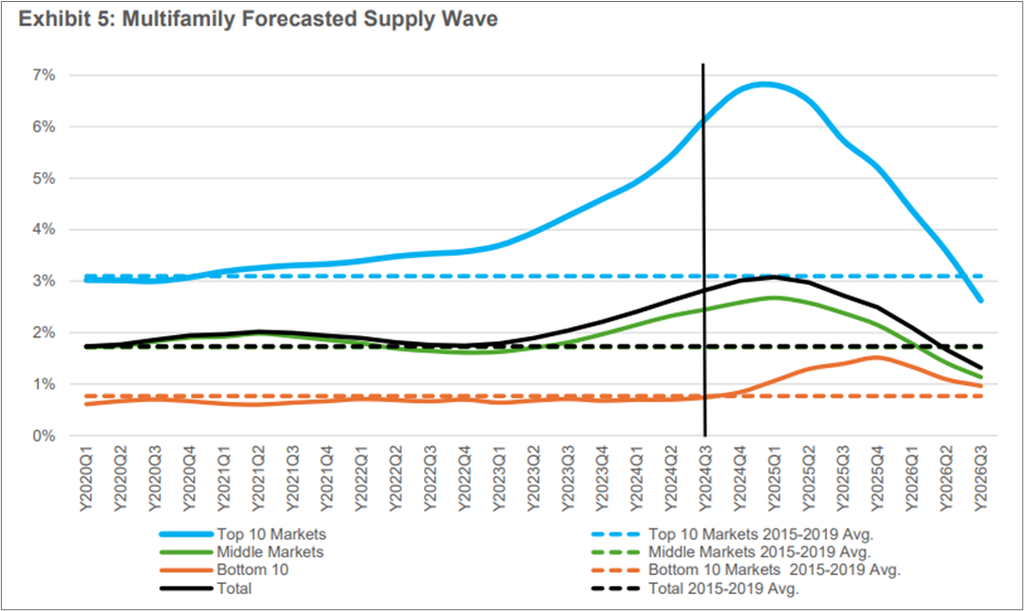

US Multifamily New Supply

New multifamily development supply is slowing as elevated financing costs and construction inflation have made new projects uneconomic. According to CBRE, multifamily construction starts are running 74% below the 2021 peak and 30% below the pre-pandemic average as of the second quarter of 2025. Where developers previously earned a 2% premium on yield-on-cost versus stabilized cap rates, today that spread has narrowed to around 0.5%, which does not justify new construction risk. New deliveries still remain elevated from projects launched in the 2020 – 2022 cycle, with nearly 450,000 units completed in 2024 and a further 83,000 units delivered in the second quarter of 2025. This supply is expected to keep markets balanced in the near term, but beyond 2026 new deliveries will decline as the slowdown in starts works through the pipeline.

Source: Freddie Mac 2025 Multifamily Outlook

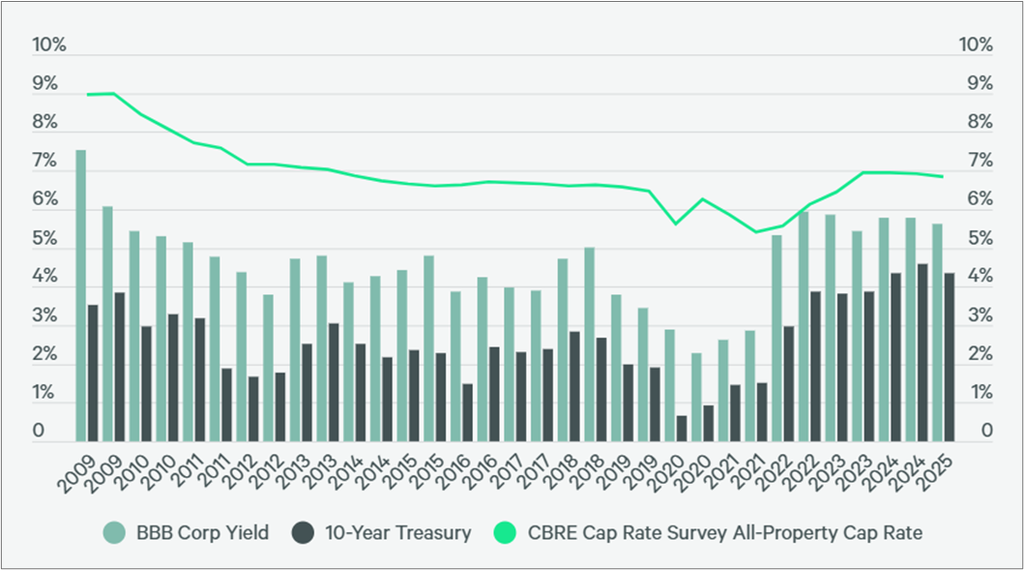

US Multifamily Cap Rates

US multifamily cap rates have reset higher from underwriting assumptions of 4.25% to 4.50% in 2021–2022 to current levels of 5.25% to 5.75%, which are closer to long-term averages. This repricing has reduced multifamily property values by approximately 20% to 30% from peak levels. One of our general partners noted that a 0.5% change in cap rates translates into roughly a 10% change in asset values. The impact is most pronounced in weaker assets and oversupplied markets. Class B and C properties with higher delinquency rates or located in metros facing elevated new supply are trading at the steepest discounts. In contrast, high-quality Class A assets in core markets continue to attract competitive bidding with only modest adjustments in pricing. Investors underwriting acquisitions today are generally assuming exit cap rates at around their entry cap rates.

According to CBRE (see graph below), cap rates appear to be at or beyond their cyclical peak. This comes despite volatility in both the stock and Treasury markets during 2025, with the 10-year yield moving sharply before settling near 4.2% by mid-year. CBRE’s survey data shows that average cap rates across all property types declined by 9 bps in the first half of 2025, with an increasing share of respondents expecting stability or compression going forward. Importantly, cap rate movements that were previously dispersed across property sectors are now more consistent and broadly aligned, which has historically been hallmark of markets transitioning past their peak.

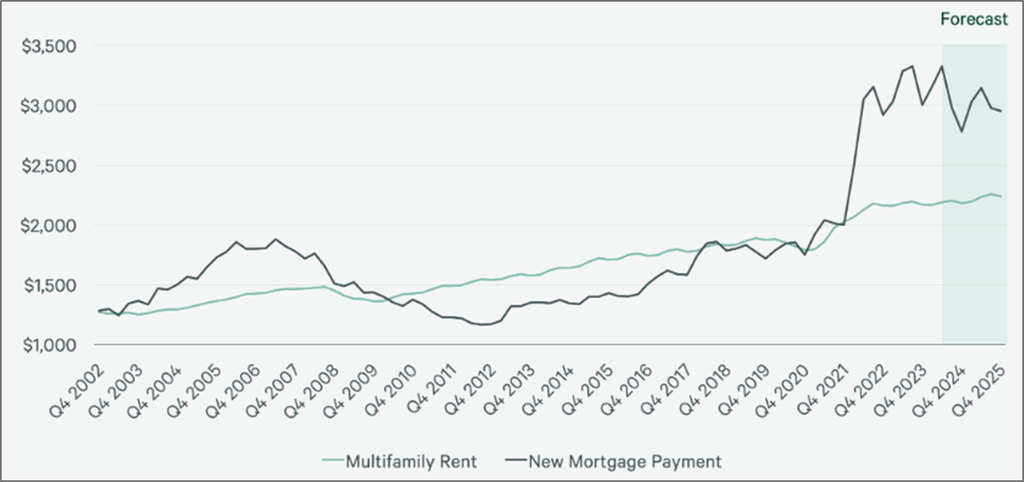

US Multifamily Rent Growth

The gap between the monthly cost of owning and renting is expected to sustain renter demand through 2025. Elevated mortgage rates and high home prices will continue to keep many prospective buyers from entering the housing market. Close to 80% of existing homeowners have mortgage rates below 5%, which reduces their incentive to sell and limits resale supply. As shown in the graph below, the average monthly mortgage payment in 2025 is projected to be around $3,000, which is roughly 50% higher than the average monthly rent of about $2,000. CBRE projects that these dynamics will support rent growth of more than 3% in many large markets, compared with a national average of 2.6%.

Source: CBRE U.S. Real Estate Market Outlook 2025

Demographic fundamentals remain supportive, underpinned by steady household formation, job growth in key Sun Belt markets, and continued migration flows. Rent growth expectations have normalized to 3%–4% annually, with stronger upside in supply-constrained markets such as Florida and Phoenix. Conversely, oversupplied metros like Austin, Texas face near-term headwinds but are expected to stabilize as new supply moderates post-2026.

US Multifamily Outlook

Dancap continues to see opportunities in the multifamily real estate sector, and our outlook remains cautiously optimistic. The asset class is in a period of repricing, with higher cap rates and tighter financing conditions pressuring valuations. At the same time, new supply is expected to remain constrained until at least 2026, while demand drivers such as a steady labor market and elevated mortgage costs for prospective homeowners are expected to support rental levels. Investors will need to remain disciplined, with the most attractive opportunities likely to be found in assets trading at discounts to prior valuations and in markets with stronger underlying fundamentals.

Historically, Dancap’s minimum target for multifamily value-add has been a net 15% IRR and a net 2.0x MOIC over a five-year holding period. However, considering the current higher interest rate environment, we are now targeting returns closer to net 20% IRR, reflecting both the challenges and opportunities in today’s market.

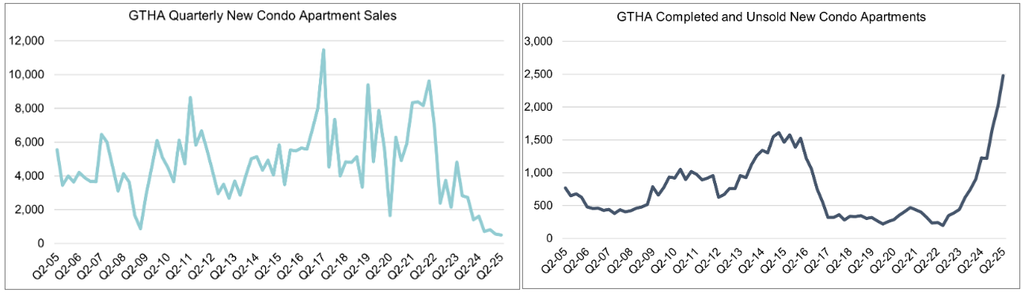

Greater Toronto Area (GTA) Multifamily Strategy

According to Urbanation, the GTA’s new condominium apartment market recorded only 502 sales in Q2 2025, 91% below the 10-year average and at 30-year lows. Sales declined 10% from Q1 2025 and were down 69% year-over-year. Historically, the second quarter has been the strongest period of the year for new condo sales. Inventory of newly completed but unsold condominium apartments reached a record 2,478 units in Q2 2025, more than double the level in 2024 and over five times higher than in 2023. Developers sold just 131 units from completed projects during the quarter, leaving the market with approximately 60 months of supply of standing inventory.

Asking prices for this completed inventory averaged $1,212 per square foot, a 6% decline year-over-year and down 16% from the market peak two years earlier. Developer activity also remains under pressure from higher construction costs, elevated interest rates, and tighter financing conditions. New condo starts fell to 1,276 units in Q2 2025, a 57% decline from a year earlier and an 84% drop compared to two years ago.

Source: Urbanation; Completed Condo Inventory Swells to Record High in Q2 2025

GTA Multifamily Outlook

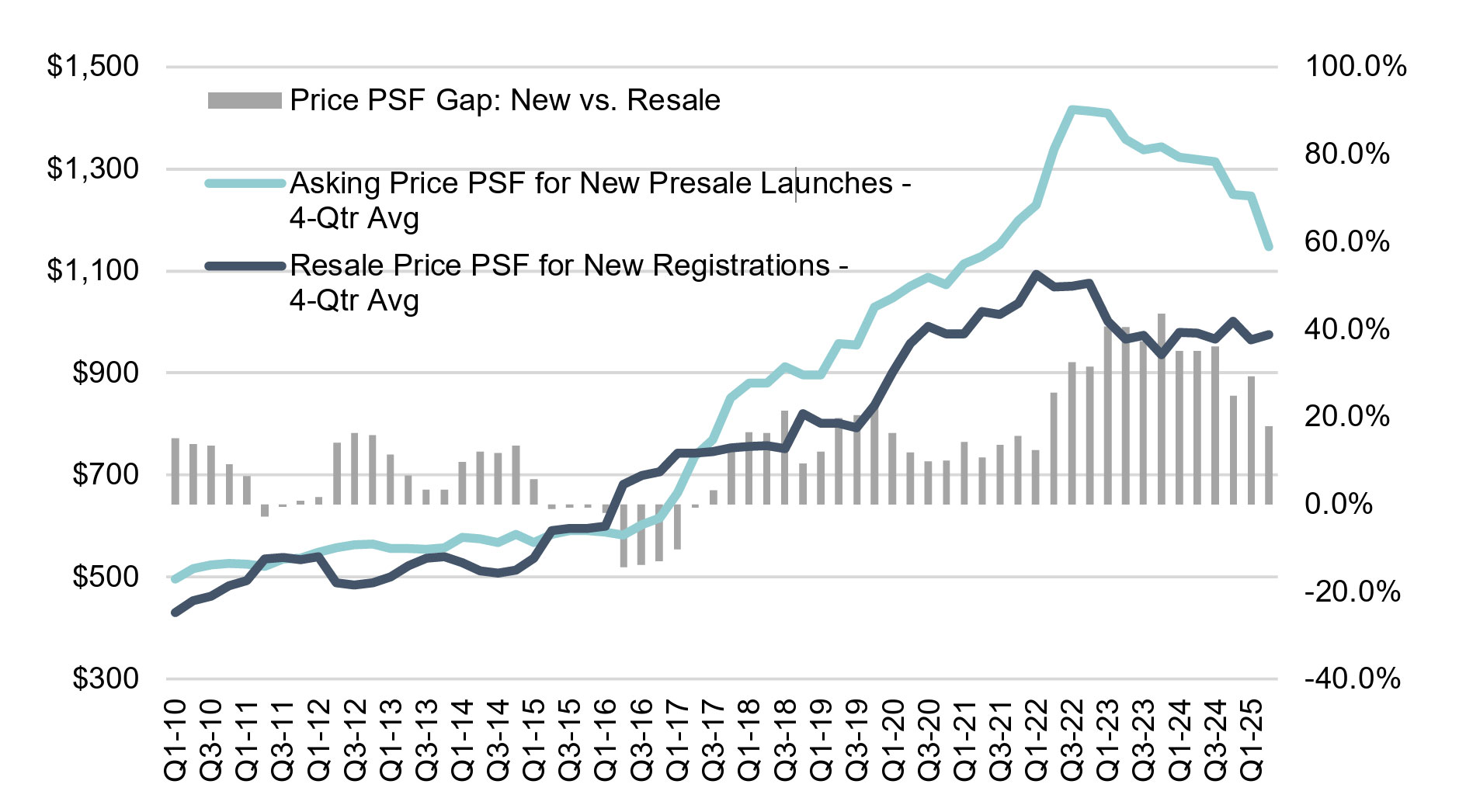

According to Urbanation, presale condo prices are expected to keep declining in 2025, falling a total of 15% to 20% from the 2023 peak of about $1,400 psf to roughly $1,150 psf this year. The price premium of presale over recently built resale units has narrowed from a 40% peak to 18% as of Q2 2025, essentially back to pre-pandemic norms seen in 2018–2019. That said, according to Urbanation, in order to pull the ‘typical mom-and-pop’ buyers off the sidelines, the premium likely needs to compress to below 10%. At the same time, during the first half of 2025, resale condo transactions in the GTA for units under $500K increased 47% from the same period last year to reach a four-year high. There are numerous private equity groups actively raising funds and acquiring blocks of unsold units.

Source: Urbanation & CIBC; The housing market – where are we? September 11, 2025

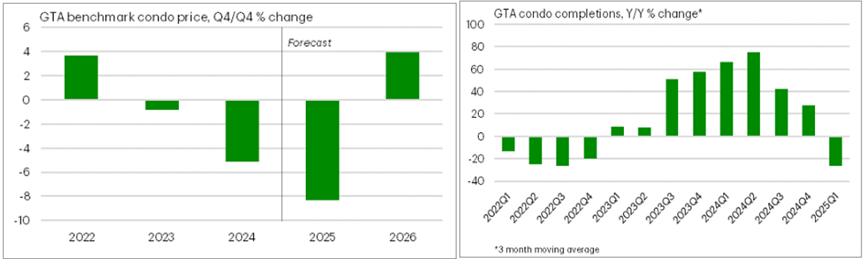

Looking ahead to 2026, TD expects condo prices to increase by 4% year over year, although still 15% below their 2023 peak price levels. Slightly prices in 2026 are expected to be supported by lower interest rates, with the Bank of Canada projected to cut rates by another 50 bps by year end to 2.25%, as well as reduced tariff uncertainty, modest job growth, and a government pledge to cut development charges by half. That said, affordability is likely to remain strained, limiting the scale of any potential bounce back in prices.

To see the Dancap Real Estate Investment Criteria and Portfolio, please click here.