2025 Outlook Private Equity

Disclaimer: The information and materials prepared are for internal use only and on how the Dancap Family Investment Office (“Dancap”) views current market dynamics. Dancap does not guarantee the accuracy or completeness of the material and it is not intended in any manner to be investment, financial, legal, accounting, tax or other advice and should not be relied upon.

Dancap's Current Private Equity Strategy

October, 2025

Dancap has more than 30 years of experience investing in private equity through third-party funds, co-investments, and direct investments. Our private equity portfolio is diversified across strategies and geographies, with a primary focus on U.S. buyout and, to a lesser extent, secondaries and expansion capital. We invest in managers with proven track records across multiple market cycles, consistent teams, and repeatable strategies, with a preference for buyout managers acquiring control positions with a defined exit path. This market overview reflects our current dynamics, outlook, and risks as they relate to Dancap’s private equity portfolio positioning.

Buyout Strategy

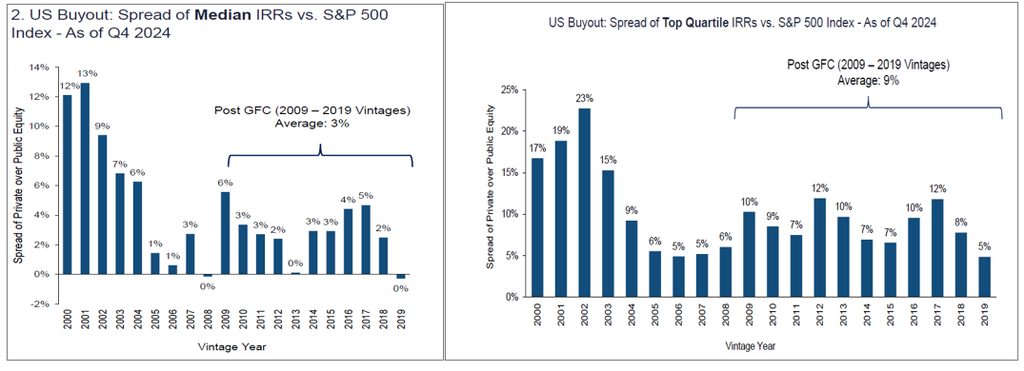

Since 2000, U.S. private equity buyout has consistently outperformed public markets, with the median U.S. buyout manager generating roughly 4% annual alpha over the S&P 500, reflecting private equity’s illiquidity premium. As more managers have entered the space, that alpha has narrowed slightly, but only to about 3%. Top quartile managers, however, continue to significantly outperform public markets, generating 10% annual alpha since 2000 and 9% alpha for 2009–2019 vintages. This dispersion between median and top quartile performance underscores the importance of manager selection, as the most consistent managers tend to generate strong operational value across market cycles.

Sources: Goldman Sachs Private Equity Outlook: 2025 and Beyond

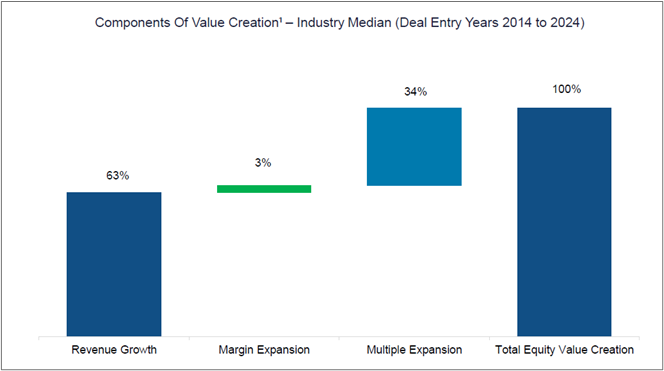

Industry data shows that the majority of private equity returns have historically come from operational value creation. Across U.S. buyout, roughly two-thirds of returns over the past decade (2014 – 2024) has been driven by revenue growth and margin expansion, while about one-third has come from multiple expansion. With market multiples elevated following the 2020–2022 cycle, the scope for multiple-driven gains is expected to be limited going forward. The key question for investors is how much of future returns must come from organic revenue growth and margin expansion to meet their overall return targets?

Source: Goldman Sachs Private Equity Outlook: 2025 and Beyond

Buyout Outlook

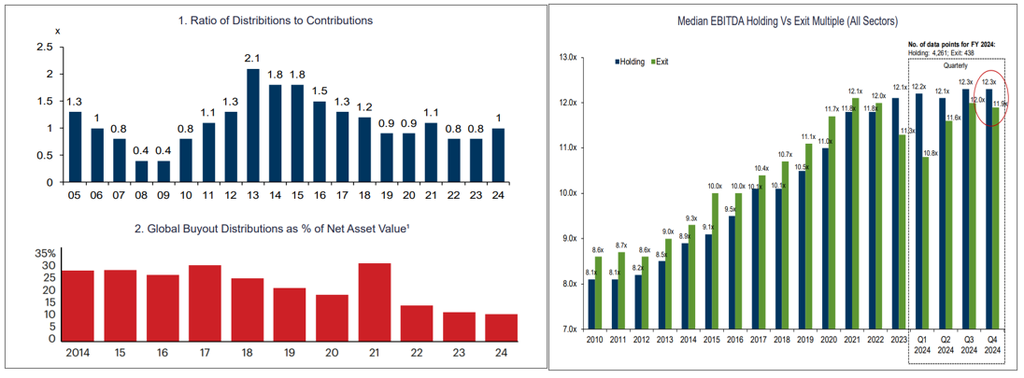

Private equity distributions have slowed down meaningfully since 2021, with distributions running in the low-teens as a percent of NAV compared to a more “normal” mid-20% range. Goldman Sachs notes that the slowdown is not due to exit markets being shut, as many investors perceive, but rather to a lack of value creation in portfolio companies acquired at peak valuations during the 2020 to 2022 cycle. Elevated entry multiples, combined with higher interest rates, have left many companies marked at 20% to 25% above levels supported by today’s financing and valuation multiples environment. As a result, general partners have been unable to exit, opting to hold companies for longer in hopes of growing into existing valuations. Unless valuations reset, exit activity will likely remain muted, distributions will stay under pressure, and LPs will continue to face liquidity constraints.

Sources: Goldman Sachs Private Equity Outlook: 2025 and Beyond

Secondaries

Strategy

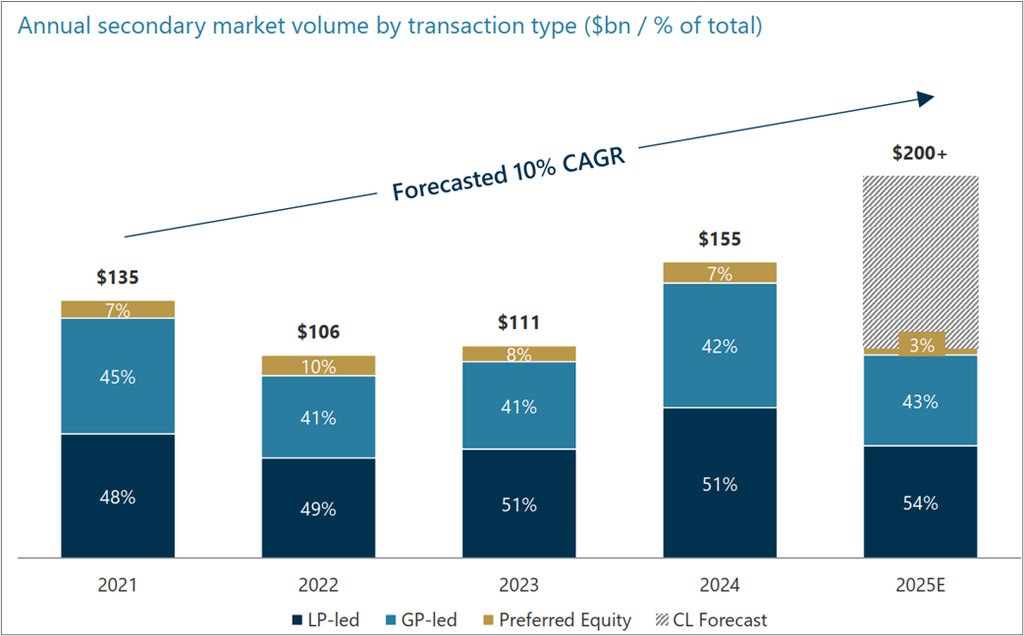

The private equity secondary market continues to expand at a strong pace, with global volumes reaching $110B in 1H 2025, up 59% year-over-year and already 71% of full-year 2024 activity, according to Campbell Lutyens. During the first half of 2025, LP-led transactions represented 54% of activity, as liquidity-constrained investors rebalanced portfolios and freed capital for new commitments. GP-led transactions made up 43% of deal flow, reflecting the mainstream use of continuation vehicles as sponsors look to extend ownership of trophy assets and provide distributions in a muted exit environment. According to research from Jefferies, single-asset continuation vehicles remain the most active form of GP-led secondary solutions, with concentrated buyer demand supporting pricing at or above par for a majority of deals. Multi-asset CVs are also gaining share, providing diversification opportunities for buyers.

Source: Campbell Lutyens H1 2025 Secondary Market Overview Report

Secondary funds continue to offer an attractive risk-return profile. By mitigating the J-curve effect and providing access to diversified pools of assets, secondary funds have proven their strategy in a rapidly changing market environment. Favorable pricing opportunities, including discounts on assets driven by liquidity pressures, further enhance the appeal of secondary investments in today’s environment. Investors seeking to capitalize on the opportunities within this space may want to focus on managers with strong expertise in both traditional LP-led and GP-led transactions.

Secondaries Outlook

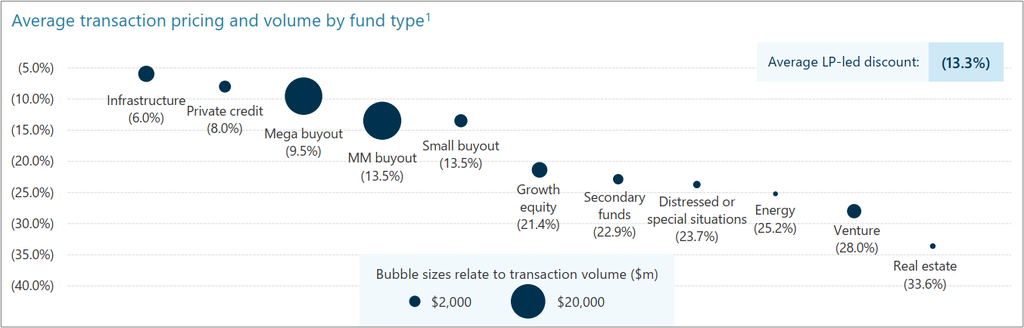

The outlook for private equity secondaries remains constructive, supported by resilient pricing and strong capital formation. According to Campbell Lutyens, LP-led transactions priced at 87% of NAV in 1H 2025, essentially unchanged from 2024 levels despite record supply, with buyout funds trading at average discounts in the 9% to 13% range, broadly in line with long-term norms. Research from Jefferies notes that more than half of GP-led transactions are now selling at or above par, led by single-asset continuation vehicles, reflecting both heightened competition and ample capital looking to be put to work.

Source: Campbell Lutyens H1 2025 Secondary Market Overview Report

Strong secondaries fundraising has further strengthened the market’s activity, with Campbell Lutyens reporting over $31B raised for GP-led dedicated strategies and more than $10B raised by evergreen vehicles in the past 18 months, many of which are willing to pay premiums for high-quality assets. With pricing stable, supply abundant, and dry powder growing, the secondary market is positioned as a critical liquidity outlet in private equity, providing LPs and GPs with much-needed distributions and exits.

Dancap's Current Expansion Capital

Strategy

A small portion of Dancap’s private equity portfolio is allocated to managers who invest in private companies seeking capital to sustain or accelerate growth ahead of a potential sale or IPO. Dancap looks to partner with managers targeting scalable businesses with proven products, clear customer adoption, line of sight to at least US $10M in annual recurring revenue within 12 to 18 months, and a clear path to exit within five years. Our managers in this space have very deep track records, consistent teams, and sector-specific expertise, focusing either on earlier-stage institutional rounds or on later-stage companies that are approaching IPO, rather than pursuing both strategies. Dancap targets returns of at least net 25% IRR and 2.5x MOIC for these types of investments.

Expansion Capital Strategy

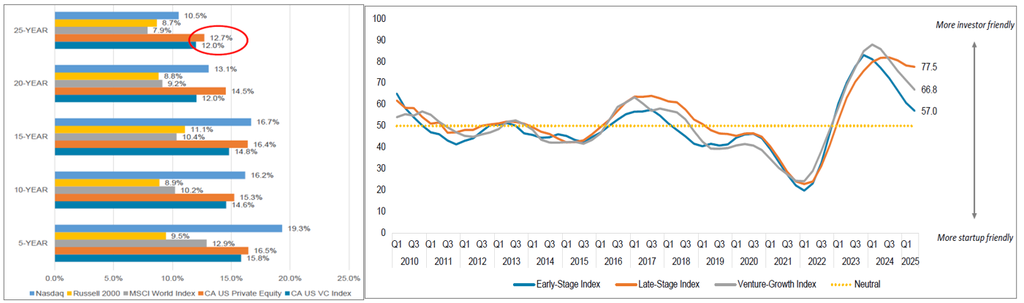

Long-term data continues to support expansion capital’s role as a high-returning asset class. Historical performance shows that U.S. expansion capital has outperformed public indices including the NASDAQ, Russell 2000, and MSCI World Index. Over the past 25 years, expansion capital has generated 12% annualized returns compared to 7.9% to 10.5% for public indices (see below). This persistent performance gap reinforces our conviction that, despite inherent illiquidity and volatility, expansion capital remains a key driver of long-term value creation and portfolio diversification. The asymmetric upside profile is particularly attractive in today’s environment where public markets face structural pressures from interest rate policy, margin compression, and geopolitical uncertainty.

From a tactical perspective, current market conditions remain highly favorable for disciplined expansion capital investors. Market dynamics indicate that the current environment remains investor-friendly (see below), particularly at the late stage, while early-stage valuations have shifted closer to neutral territory. This is being driven by companies that raised large rounds in 2021–2023 now returning for additional funding, creating a supply-demand imbalance and strengthening investor leverage.

Expansion Capital Outlook

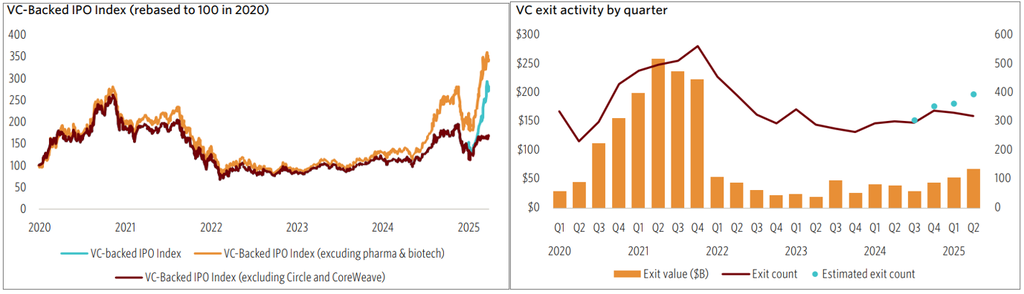

Even though public markets have been volatile throughout most of 2025, IPO activity has started to pick up since the second quarter. Circle Internet Group completed a $1.2B IPO in June, CoreWeave raised $1.6B in its listing, and Venture Global also came to market with a $1.8B offering. On the M&A side, notable transactions included SoftBank’s $40B investment in OpenAI, Alphabet’s $32B acquisition of cybersecurity firm Wiz, and Constellation Energy’s $17B purchase of Calpine. This recent activity demonstrates renewed momentum in sectors such as AI, defense technology, fintech, and crypto, which continue to attract outsized investor interest.

JP Morgan notes that some companies that have been targeting 2026 IPO listings are now accelerating preparation in order to keep open the possibility of launching an IPO by Q4 2025. Historically, receptive IPO windows have appeared both before and after the U.S. Thanksgiving period, and based on recent deal flow, issuers will look to take advantage of these windows if conditions hold. At the same time, demand for late-stage private company exposure remains elevated, providing additional support for near-term issuance.

To see Dancap’s Private Equity Portfolio and Investment Criteria, please click here