2025 Outlook Private Credit

Disclaimer: The information and materials prepared are for internal use only and on how the Dancap Family Investment Office (“Dancap”) views current market dynamics. Dancap does not guarantee the accuracy or completeness of the material and it is not intended in any manner to be investment, financial, legal, accounting, tax or other advice and should not be relied upon.

Dancap's Current Private Debt Strategy

October 2025

Dancap has over 25 years of experience investing in private debt through third-party fund managers and co-investments. This market overview reflects how Dancap’s private debt portfolio is currently positioned, highlighting its alignment with our investment strategy, geographic allocation, and an analysis of prevailing market dynamics, outlook, and potential risks. The majority of Dancap’s private debt exposure is allocated to third-party managed funds that focus on U.S. senior secured, floating-rate, sponsor-backed corporate lending strategies. These strategies, with modest leverage, aim to deliver strong risk-adjusted returns, downside protection, and stable income, particularly in a rising interest rate environment. Our private debt managers have long-standing track records across multiple market cycles and work with sponsors who bring proven expertise in their fields. Our senior secured lending strategies target minimum net returns of 10% IRR, while our second-lien and mezzanine strategies target minimum net returns of 15% IRR. This approach reflects our focus on maintaining a balanced portfolio with attractive returns and risk mitigation. Generally speaking, for private credit strategies, our preference is to invest in the senior part of the capital structure, with most of the returns coming from quarterly yield distributions.

US Private Debt Strategy

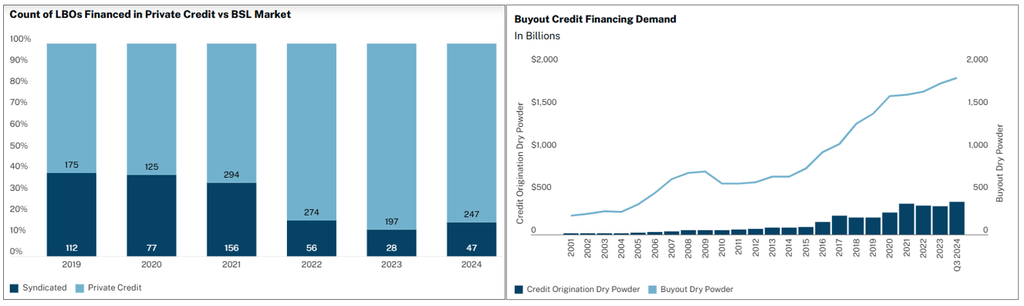

Stringent bank regulation following the 2008 Global Financial Crisis has accelerated the shift in market share away from broadly syndicated loans and toward private credit lenders. Over the past five years alone (since 2019), total loan volume financed by private credit has doubled to 80% from 40%. In today’s environment with heightened volatility and uncertainty, borrowers are increasingly turning to private lenders for greater certainty of execution. Pundits have argued that private credit is overcrowded, but the data shows otherwise. As of Q3 2024, there was a $1.4T gap between buyout capital raised by private equity funds and the credit capital raised by credit funds to finance those deals, and when you add the $600B maturity wall of performing loans coming due through 2028, the overall funding shortfall approaches $2T, leaving ample room for continued growth.

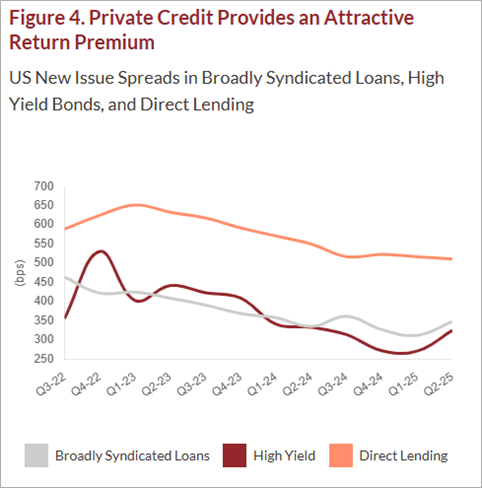

Private credit new issuance loans today offer a 5.0% to 5.5% spread over SOFR, compared to ~3.5% for broadly syndicated loans and ~3.0% for high yield bonds. The premium is meaningful, particularly given that private credit sits at the top of the capital structure with senior secured exposure and is predominantly sponsor-backed. Despite carrying similar underlying borrower risk to liquid markets, private credit generates unlevered returns in the 9%–10% range, providing investors with a more compelling risk-return profile and stable income in a higher-for-longer rate environment.

Source: Northleaf Capital; Private Credit Market Update: Q2-2025

Defaults in private credit are increasing but not yet critical. JPMorgan reports a private credit default rate of 2.4% for Q1 2025, up from 2.0% in Q4 2024, across a $1.4T market, with non-accrual loans pushing the effective default rate to 5.4%. Most defaults involve amendments like maturity extensions rather than missed payments, particularly in mid-market firms. Strong covenant protections in deals under $100M EBITDA allow early lender intervention, limiting systemic risk. This supports cautious optimism as disciplined underwriting continues to contain distress.

US Private Debt Outlook

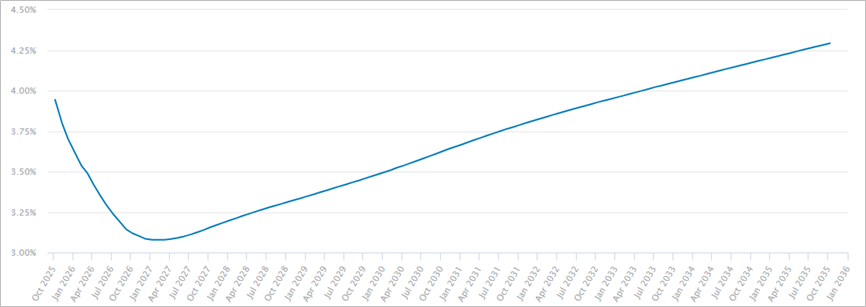

As of October 2025, markets are pricing in three to four additional Federal Reserve cuts totaling 75 to 100 bps by the end of 2026, yet interest rates are still expected to remain higher for longer than in the prior 15 years. The U.S. 3-month forward SOFR curve, which serves as the reference rate for the private credit markets, is projected to decline to a low of about 3% by January 2027, down from 4% today (see chart below), but still well above the average rate of 1% from 2012 to 2021. Private credit investors should benefit from an additional 200 bps of floating yield relative to the decade preceding 2022’s rising interest rate environment. Looking further ahead, the 3-month SOFR rate is expected to average between 3% and 4% over the next decade, positioning private credit investors to capture even higher returns in the decade ahead.

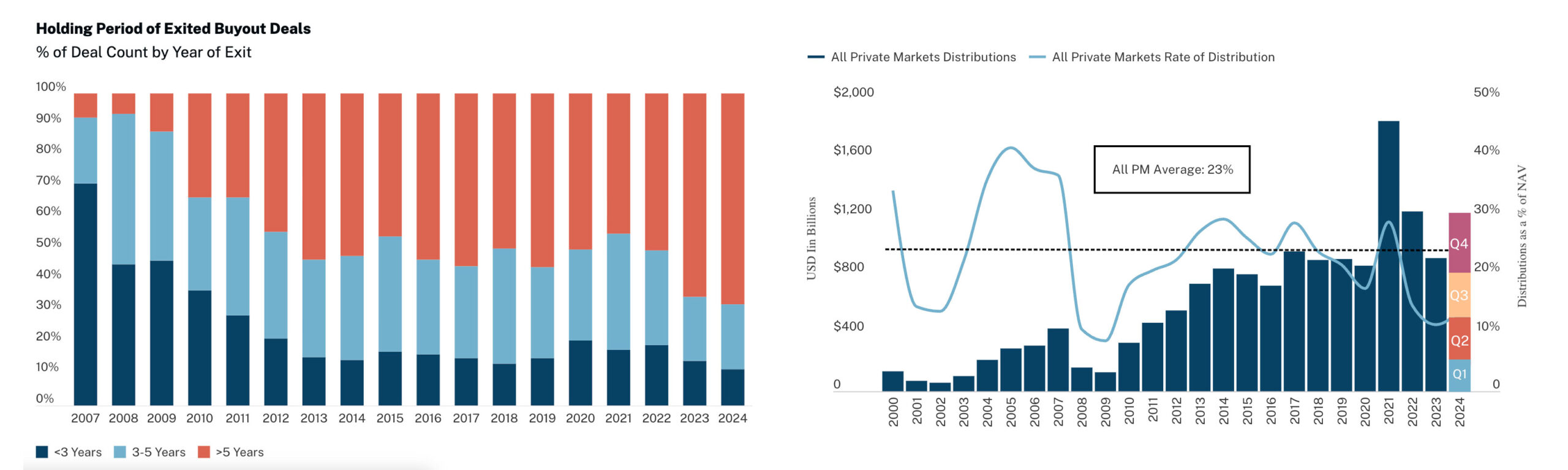

Current market conditions are aligning to private credit’s advantage as limited partners (LPs) invested in private equity continue to face liquidity constraints as hold periods extend. In 2024, more than 67% of buyout exits involved assets held for over five years, and distribution activity across private markets stayed well below the long-term average of 23% (see charts below). According to Hamilton Lane, these conditions are catalyzing demand for creative liquidity solutions, including continuation funds and GP-led financing structures. As private equity GPs hold onto companies for longer, they will need to refinance their debt, and private credit managers are well positioned to support these types of transactions.

In today’s uncertain market environment, Dancap continues to emphasize investing in private credit managers with deep track records across market cycles, strong expertise, and stable teams executing consistent, repeatable strategies.

To see the Dancap Private Credit Investment Criteria and Portfolio, please click here.