2025 Outlook Hedge Funds

Disclaimer: The information and materials prepared are for internal use only and on how the Dancap Family Investment Office (“Dancap”) views current market dynamics. Dancap does not guarantee the accuracy or completeness of the material and it is not intended in any manner to be investment, financial, legal, accounting, tax or other advice and should not be relied upon.

Dancap's Current Hedge Fund Outlook

October, 2025

Dancap has a long track record of investing in hedge funds across a wide variety of strategies, utilizing both third-party managers and separately managed accounts. This market overview aims to provide an update on the broader hedge fund industry, including current market dynamics, outlook, and risks. Dancap’s hedge fund portfolio is strategy-agnostic, partnering with managers who possess deep track records and expertise across various market cycles. Dancap favors hedge funds that offer competitive liquidity terms, often with quarterly redemption or better, and we generally avoid funds with hard lockups and side pockets.

Hedge Fund Strategy

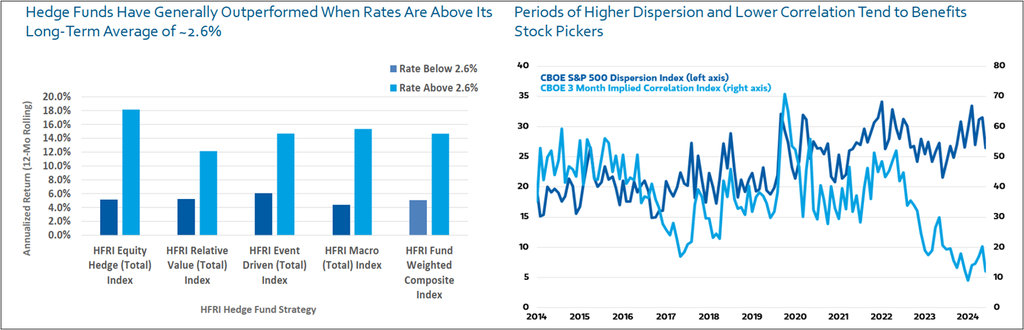

Hedge fund strategies in general tend to perform well in a higher interest rate environment, as shown in the chart to the left below. Higher interest rates tend to coincide with higher market volatility, leading to higher stock dispersion and greater return potential. As noted in the chart below, equity hedge (i.e., long/short) strategies tend to outperform other hedge fund strategies due to their ability to generate alpha through their long/short approach, capturing relative market movements across single stocks, sectors, and asset classes. Furthermore, equity hedge strategies typically exhibit low correlation with broader markets, which offers diversification benefits across investors’ portfolios.

Source: Morgan Stanley 2025 GIMA Alternatives Investment Themes

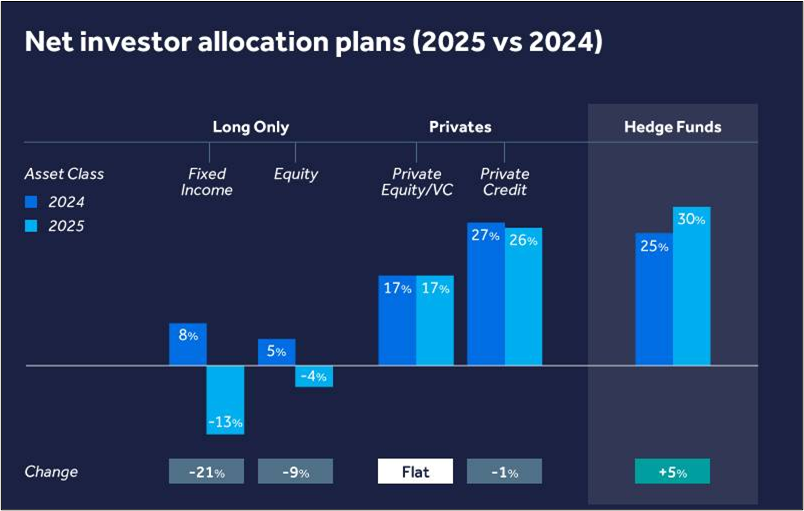

According to the 2025 Barclays Strategic Consulting Investor Survey (representing $8.6T of AUM across 325 institutional investors), hedge funds are set to receive the largest net allocation increase among major asset classes. As shown in the chart below, 30% of institutional investors expect to increase hedge fund allocations in 2025, up from 25% in 2024, representing a net gain of +5%. This stands in contrast to long-only public equity and fixed income strategies that are projected to see net outflows (–9% and –21%, respectively), while allocations to private equity and private credit are expected to remain stable. Taken altogether, the survey results point to a rotation of capital away from traditional long-only exposures and into hedge fund strategies.

Source: Barclays Strategic Consulting Survey, 2025

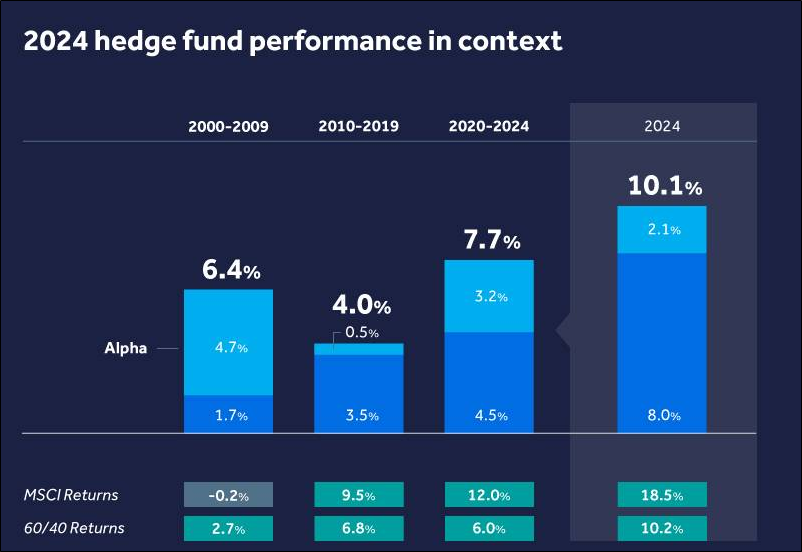

Hedge Funds Outlook

In 2024, hedge funds delivered average net returns of 10.1% and generated 2.1% alpha, representing their strongest annual performance since before the Global Financial Crisis. For context, between 2010 and 2019, when interest rates were low and equity markets were less volatile, hedge funds produced only 4.0% net returns and less than 1% alpha, while over the more recent 2020–2024 period they averaged 7.7% net returns with 3.2% alpha. For context, the 2024 hedge fund return of 10.1% was broadly in line with the 10.2% return of a traditional 60/40 public equity and fixed income portfolio. This returns comparison suggests that going forward, hedge funds could provide higher returns with lower risk, as many hedge fund strategies such as equity long/short are designed to offer market upside participation while incorporating embedded downside protection.

Source: Barclays Strategic Consulting Survey, 2025

To see the Dancap Hedge Fund Investment Criteria and Portfolio, please click here.